Things were looking up, for a change...

A short review of St. Louis City's FY20 Comprehensive Annual Financial Report

Welcome to the first real post of #STL is a racket, where I’m gonna be following the money in St. Louis politics. While I know that there are far juicier topics to cover, I’ve decided to start off the blog’s work with a look at the city’s recently released FY20 Comprehensive Annual Financial Report (CAFR). For those who aren’t familiar, the CAFR is a quick-and-dirty annual audit of the city’s finances. It’s not an ultra deep dive into the city’s activities, but it does let us know where the city’s account balances stand. Or at least stood. Since this cut off in the early part of the pandemic’s economic impact, this report is like a still photo of a man falling. We don’t know how much further he’s fallen in the time since the shutter snapped. Was he badly hurt? We don’t know. We just know that he was falling.

It’s been worse, actually

The FY20 CAFR has been released and it contains some hopeful numbers. It also contains a lot of “red flags” for the city’s fiscal future. Unfortunately, we don’t know COVID’s current toll on the budget. This is because the fiscal years end on June 30th, leaving many months of lowered revenue out of the picture painted by the report. Still, the city’s Net Position has been nudging upwards. In fact, it increased by $19.9M, which is about 5% higher than the previous year. After many years of decline, recent years have seen greater savings, compared to the Slay years. As such, the city’s financial position has begun to recover. Or had begun. With COVID, all of these numbers could be illusory. We’ll need to wait for the budget process, before we’re really gonna have something akin to real time numbers.

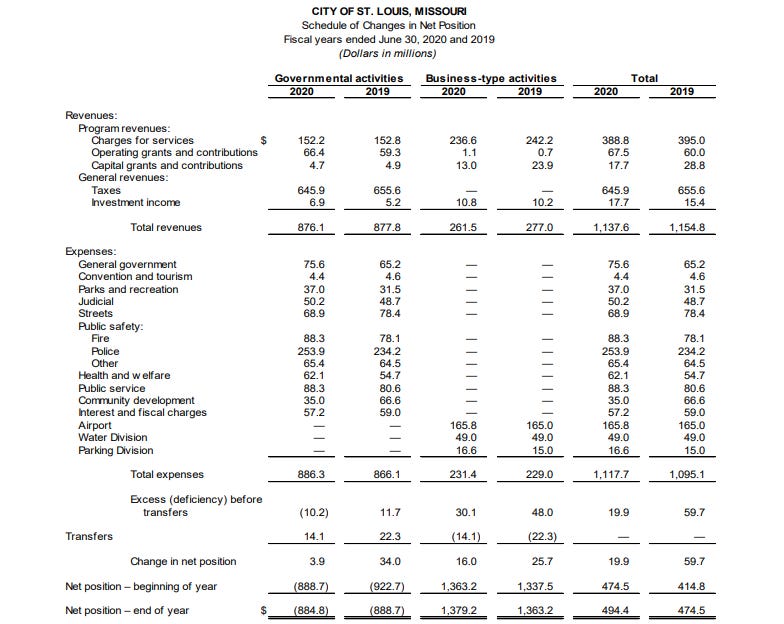

Let’s go a little deeper into the main table

Looking at the main table, which can be found on page 7 (23 of pdf), we can see that a significant portion of the increase in the Net Position comes from a significant increase in the city’s net investment in capital assets. It is unclear what drove the $120M+ increase.

One other thing that immediately jumps out at me is the massive increase in governmental activities deferred outflows, which ballooned from $75.9M to $237.4M, far outpacing business-type activities’ growth from $19M to $24.9M. Conversely, deferred inflows moved in a similar, but reversed, pattern, with governmental activities falling to close to half their FY19 numbers, while business-type activities showed a decline of closer to 25%. I don’t know what is causing this, but my guess is that unfilled positions are driving a good amount of the deferred outflows. If that’s the case, then it certainly clouds the picture. Already, the city had seen a topline decline in assets, year over year. That seems to be driven by a significant decrease in non-capital assets, which declined by over $70M. Is that the YoY decline in tax receipts? Hard to say, but it would make sense. If so, this means that our ~$20M increase in Net Position is less good news than the topline Net Position number would have you think. If that’s primarily just unfilled jobs, they would hopefully be filled. Also, there is a good chance that not filling those positions is increasing some deferred, non-payroll costs, meaning that not all of this is real savings. As an example, pension funds get money invested into them, based on the hours worked. If we have lots of unfilled positions, that’s fewer people paying into the funds, meaning fewer workers’ contributions supporting existing retirees and requiring greater investment from the General Fund. So, we may have saved money, but not filling positions doesn’t mean that the city gets to keep the whole of the savings from each position’s compensation package.

There are other things that jump out at me, but many of them don’t give a ready explanation. One such thing is the significant decrease in the business units’ liabilities, while there was a significant increase in the liabilities of the governmental units. My guess is that some asset (with debt attached) was transferred from one entity to another. That’s just a guess, though. There’s not really enough information in the main table, which limits how much can be inferred from just this one.

A little further down, the Comptroller’s office points out some of the city’s biggest fiscal liabilities:

As you can see, at the end of FY20, the city’s TIF obligations remain significant drivers of the city’s ongoing fiscal liabilities. With the decrease in brick and mortar retail and restaurant spending, most of the pre-COVID projections for paying down these developments’ debts are suspect. Well, at least for the projects that had a significant amount of sales tax revenue recapture built into the projections, which many of them did. Not only are the sales tax recapture projections probably wrong, but the future of rents on grand floor retail space has to be less rosy, compared to before COVID. The exception probably being grocery store-anchored developments. As is, these developments face a high potential for long term damage to their balance sheets and underlying debt service model. Since we’ve backed these developments with guarantees on their TIF’d debt, we’re gonna end up holding the debt on our balance sheet. Even if they pay off, many of these developments’ “break even” points have been pushed years back. Especially the numerous hotels that were recently constructed with TIF financing. In fact, City Foundry may set a new city record for fastest urban mall failure, and, in doing so, accomplish something that many thought impossible: making St. Louis Centre look relatively successful.

A more granular look at the numbers

Luckily for us, the next table gives us more information, allowing us to see where receipts have really declined.

While this chart doesn’t give all the clear answers we may be seeking, we can see some more granular information. It appears that something which used to be expenses counted towards the Streets Department numbers has been moved over to the general government line, but maybe not. I just have a bit of a hard time seeing that much of the Streets Department’s annual costs just going poof. I guess it’s possible, though. If I combed through the very extensive notes, I bet that I could find an explanation, but I don’t really have the time to read the full report. If you find the answer, let me know. If it’s different than this, I’ll edit the post to reflect the information. Further down, we see a fairly significant increase in spending on the Fire Department. While the SLMPD saw a greater raw number increase in spending, the increase to the FD is a bigger percentage increase. Of all the categories, the one that saw the biggest decrease was in Community Development, which saw an almost 50% decrease in spending. There are other things that are going up and down, but they seem to be bouncing within a normal range. One other kind of notable number is the difference in the governmental activities Net Position, prior to the transfers from the business units. Both of the years saw significant transfers, but this year’s transfer actually got the governmental activities out of a pre-transfer deficit. With COVID’s continued deleterious effects on revenues, this could be an indication that we’re going to go into this year’s budgetary round needing to cut more than $20M in services. Potentially far more. When combined, governmental and business units showed balances closer to $40M lower than at the end of FY19. If this budget year is worse than last, and it seems like it will be, we should expect to go into the budgetary process in a position that has made recent budget cuts in the $10M-$20M range look gentle. We’re talking about real cuts in services, many unfilled positions being permanently eliminated, etc. This will further erode quality of life issues in neighborhoods who can’t fund extra services via additional taxation districts, deepening the city’s racial divide.

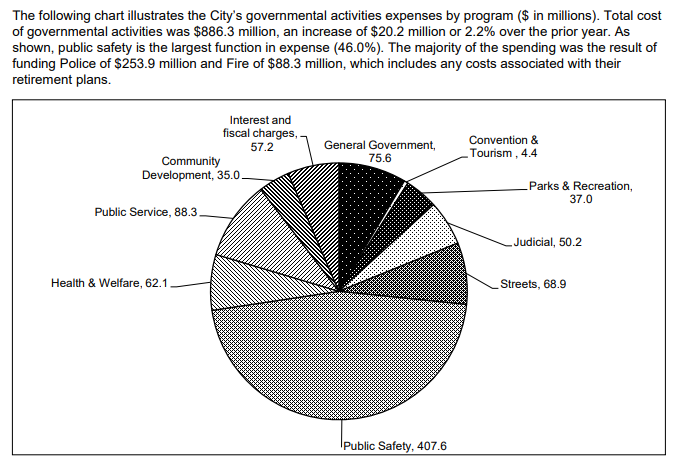

Everybody loves a good chart, so here are the numbers in pie chart format:

Here’s the YoY change chart:

As you can see, cuts to Community Development spending appear to have funded a significant portion of the increase in Public Safety spending. I don’t remember this being budgeted like that, though I could be wrong. One potential explanation of the Community Development to Public Safety funding move would be that the “Metrolink sales tax” portion that was to be dedicated to Community Development was diverted to Public Safety, when the city began facing shortfalls. There are probably other explanations, but none that come to my mind. As those were both authorized usages for that revenue, I can certainly see the city choosing to keep money flowing to SLMPD, at the expense of CDA. You can put off breaking ground on something, but SLMPD payroll keeps coming, month after month. Unfortunately, the report doesn’t give us the “why?” for all of these numbers. You can also see what looks like the aforementioned switch from Streets to General Government.

When we get to the business units, we see a very uneven playing field. The Water Department is holding steady, with YoY increases roughly in line with inflation. The airport’s Net Position actually increased, due to CARES act funding. Without another injection of federal funds, the airport’s position is likely to take a hit in next year’s CAFR. On the other hand, the Parking Division’s Net Position plummeted over 20%. And this is the second year of ~20% decreases in Net Position. I think that’s partially because of transfers to the city’s reserve fund, but reduction in Net Position seems to exceed that and subsequent statements to the press have confirmed that the Parking Division is facing significant budget shortfalls, compared to most years. Remember, this CAFR only covers the first few months of COVID, so the numbers only reflect a portion of the revenue loss due to COVID. At this point, the Parking Division is likely in a far worse position. Without the return of large events to fill the city’s garages, COVID is decimating the department’s finances in a way that is not necessarily happening to others. Even after it recovers, the shift to work from home and greater online spending is likely to be a long term negative for the department that would come in the form of reduced meter revenue. Arguably, no other department has more riding on the success of the local vaccine rollout. So, when Treasurer Jones was arguing that the Parking Division’s balance would help the department withstand a downturn, she was right. Between COVID and the transfers, the Parking Division’s balance sheet is in declining health. Long term prospects for the department are not especially bright, either. Future holders of the office will likely be inheriting a hollowed out budget.

Speaking of COVID’s damages to revenues, I did find this hard number on how much overall revenue was hit during FY20, but you had to look for it.

“The general fund revenue estimate including transfers in totaled $519.5 million. Actual results for the fiscal year’s revenues and transfers in were $508.1 million, which was lower than the original estimates by $11.4 million or 2.2% of the estimate.”

Again, we don’t know how the city was doing, prior to the pandemic, so we don’t know the actual total amount of COVID-related lost revenue. If, prior to last spring’s lockdowns, we were on pace to exceed initial estimates, the real drop in revenue would be higher. That would make this $11.4M closer to the floor than the ceiling, as far as how far off course revenues have actually gone in relation to where we thought they were going. Having the pandemic land near the end of the fiscal year does make some things hard to really see clearly, but we don’t really know how much receipts have recovered, since the initial lockdown. As such, it makes extrapolating further revenue loss estimates pretty much impossible. One should assume the same about the time that has passed during our current fiscal year. When the budget was passed, most of us were under the impression that things would return to something more normal-ish by the end of 2020. The curve was gonna flatten and we were gonna have low levels of infection, til the vaccine comes. Sitting here in our semi-locked-down January of 2021, it is safe to say that those projections were far too optimistic. I don’t know for sure, but it is very possible that the city’s budget made similarly incorrect assumptions about the rate of revenue streams’ (ala sales taxes) recovery timelines. This could result in greater spending from the reserve fund, lowering the city’s Net Position. If somebody knows Paul Payne, he could tell you. What a terrible time to have that dude’s job.

Long term debt and obligations

Well, outside of an increase in debts related to rolling stock, we’ve seen a decrease in many of our long term financial obligations. Notably, TIF debt seems to be holding fairly steady and the combination of recently announced deals and reduced sales tax receipts could put this number higher in coming years. The recent choice to back a bunch of hotels seems especially foolish, these days. Prior to most recent construction, demand for hotel rooms had already been levelling off, but now they are all getting finished and face the potential for almost no business. Even after COVID passes, it is unclear how much of the convention business will return. Even the addition of an MLS team won’t be able to keep all of the hotels profitable. As is, it is fairly difficult to imagine this crisis ending without another hotel joining the Millennium in the city’s inventory of empty downtown hotels. Here is the table showing how the city’s debts are broken down:

Now, the city’s debt isn’t its only long term fiscal obligation. The pensions are another major portion of the city’s fiscal picture. Notably, the aggregate of pension trust funds (pg 47 of PDF) doesn’t show immediate issues. This is in many ways thanks to increases in the valuation of investments. That being said, you can see how things can quickly go badly, if asset valuations decline. Without this increase in investment values, the pension funds’ Net Position would have decreased by over $100M or ~5% of the total Net Position. That’s how we could get in danger, going forward. Say asset prices drop by 20% in a market correction, while revenues are still depressed from the lingering effects of the pandemic... all of a sudden, the government would need to pour millions of additional dollars into the fund, until asset prices recover. In a major revenue downturn, this means we would be faced with truly terrible decisions. Services are already pretty bad, so they could only cut so much from streets, etc. It’s at this potential juncture that we would likely be facing the decision to either sell the Refuse Department, Water Department, airport or declare Chapter 9. Let’s all hope that doesn’t happen. The best thing that could really happen is that we thread history’s needle with just a year of painful budget cuts, lasting long enough to get federal aid and then see rebounding revenues. The alternative is far worse. If we are to avoid a crisis in the pensions, continued high valuation of assets is key. We are currently at the high end of historic standards, so that is not guaranteed. If asset valuations revert to something closer to mean, the pension funds would become almost instantly worrisome. Luckily, we’re not there. As you can see, the pension funds’ net position decreased, but not in an alarming manner:

Summing up

There are a lot of things that you can take away from the document, but the biggest has to be uncertainty. In many ways, this is a snapshot of a municipal budget in flux. With the pandemic, we know that YoY receipts are likely to be even worse, once the current FY is over and next year’s CAFR is released. It really puts a fine point on the need for federal action to shore up lower level governments’ financing. If we’re facing cuts in the ballpark of $30M+, then folks will most likely experience them. That’s a lot of unfilled potholes or garbage routes run. I wouldn’t be surprised to see increases in fees, wherever they can do so. On top of high sales and property taxes, the city will be dumping even higher cost of living increases on folks, making it even more inhospitable to those who fall on the lower end of the economic spectrum. In turn, this will increase the rate of demographic change in the city, as whites will be more likely and willing to pay the high cost of living that comes with being in the city, compared to many suburbs. This will serve to put increased pressure on Black families to move to St. Louis County or other suburban destinations. As such, any budget crisis could end up speeding gentrification, even if that seems somewhat counterintuitive. We should all hope that the incoming Biden administration is able to secure funding to support state and local governments. Otherwise, the next mayor will face questions far worse than either Slay or Krewson, despite the fact that both spent most of their time as Mayor cutting budgets. None of the folks who are running for mayor are talking about this, which is making it almost impossible for voters to actually make their choice of vote a rational decision. This is the question that faces the next Mayor. Everything else flows from the budget situation. Any voter who cares about the city needs to be asking all of them one question: what would you cut?

What voters need to know is what they will cut. What positions will be eliminated? Where will you get the money to pay for never ending increases to public safety spending? If you’re not gonna do that, then please say how much you are proposing to cut the police budget. Oh, and you can’t just say “closing The Workhouse.” Last year’s annual police annual budget increase was greater than the current budget for The Workhouse. In other words, the money’s not there. Just inflation to the SLMPD budget would likely be equal to the savings available from closing The Workhouse. After the most violent year in recent history, my guess is that the Board of Aldermen will have no appetite for reducing police funding. If anything, just keeping spending at FY20 levels would be a win. The point being is that quick and easy “answer” isn’t actually an answer. We need to close that facility, but its closure can’t solve this particular problem. Pretending that it will does us no good.

Slay left office with serious fiscal issues that put the city in a position where a significant economic downturn could lead to bankruptcy. Krewson’s term largely was still under an unprecedented expansion, but the downturn is here. If anything, she’s also getting out, before the real bad stuff starts. Just like Slay thought he was probably doing. If anything, her administration’s focus on rebuilding the reserves was arguably her most important budgetary policy change, compared to her predecessor, and I think that we can all see why increasing the city’s “rainy day” fund was important. Whoever succeeds her will likely face very hard questions, but those questions will be a little bit easier, due to the recent increases in the reserves.

So, there is a ton more in the report, if you’ve got the time to dig through it. I just wanted to try and help folks make some sense of the main tables. This is a snapshot of the city’s budgetary situation. Due to the impact of COVID on revenues, it is already quite dated, despite being recently released. The upcoming budget proposal is going to paint a far clearer picture of the city’s COVID-impacted financial position.