A quick check back at the SLMPD pension

It's been a year, and numbers are pretty much right where we left them

Well, if you don’t follow the news, everybody at EHOC recently got laid off. That means we all have to find new gigs. If you happen to know someone needs help doing stuff around redlining, etc., let me know! Honestly, I kinda doubt that I’ll be able to stay in that same field. To call my former job of analyzing lenders’ Community Reinvestment Act performance and the related federal regulatory stuff “niche” would be an understatement. I was essentially the only person on the consumer side that got paid to do that work in the entire state of Missouri. I’ve got my fingers crossed that a SLEHCRA coalition member will find the funds to bring me on part time for that stuff, but I am not holding my breath. The layoff also means that I have more free time to check in on the city’s financial picture. That means you’ll probably be getting a few more of these emails, though not a ton. At least until I land a new gig, I’m gonna be bored and writing is something I can do to fill the time.

There won’t be a ton of posts, as there’s not really that much of interest going on in the city. The city feels like it’s just on decline autopilot. In many ways, there are lots of Slay’s second term vibes going around. The Board of Aldermen is still a clown show, but they do so little that it’s hard to justify spending much of any time thinking about them. I told people that cutting the number of alders wouldn’t really fix anything, and it hasn’t. If anything, those folks living in lower income areas of the new larger wards are seeing less of their alders, while they spend their time in the wealthier, more-vote-and-contribution-rich parts of their larger wards. I also don’t care about all of the gimmicky things the alders are passing. The city infrastructure is crumbling, which is why I don’t care about the alders passing ordinances that only take effect in the event that the state GOP changes core positions. That’s ridiculous. We elected them to actually govern the city. What is going on is not governing. This is just partisan demagoguery. It’s insane that these folks just got their salaries doubled. Most of the ones with other jobs kept their other jobs, too. One of the main reasons given for consolidating and increasing salaries is that these folks would all become full time. Of course, that was nonsense. They just make more money, while doing the same (very, very small) amount of work. That said, there are some upcoming fiscal documents that will be interesting to look through. There will be the Annual Comprehensive Financial Review (ACFR) and new round of annual budget hearings coming up. If my unemployment stretches that far, you’ll probably get an analysis of both. Hopefully, I’ll have a job, and we will all be saved another one of my looks at the city’s Net Position, etc. A lot of that will be timing. Some years, the Comptroller’s office gets the numbers out around New Years. Other years, it can be into late winter. If there’s real numbers for me to look at, I might write something up. If it is the soap opera drama that folks seem to spend their time talking about online, I will not be writing it up.

The pension’s numbers

That brings us back to the city’s police pension fund. As always, the SLMPD pension is an important part of the city’s overall fiscal picture. It ha a huge impact on the budget, as yearly shortfalls are made up by contributions from the city’s general fund. In times of declining asset prices, it can be a real strain on the budget. Even when we’re not in crisis, it seems that the city’s annual contribution grown into a significant sum. This is due to the fact that the city’s pensions essentially haven’t recovered from the hole that the 2008 housing crash and Great Recession blew in the balance sheet. We last looked at it in December of last year. In the time that’s passed, not much has really changed. We’ve got a slight YoY increase in the fund’s value, relative to what is owed to retirees. It is not by much, though. I don’t want to minimize the gain, but it close enough that I hesitate to make folks think that we’ve made real progress, when it is within the investing equivalent statistical noise, given recent inflation rates. This increase does outpace the value of benefits owed, but growth is basically at the rate of inflation. All things considered, I think it is fair to say that we’re treading water.

Let’s take a look at these relatively unexciting numbers.

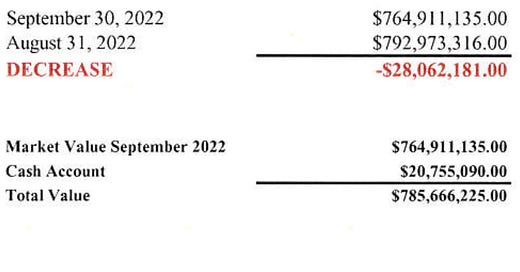

Here you can see the numbers as of when I checked in on this stuff around the same time, last year. The main story from last year’s post on the topic was that this represented a fairly steep decline, compared to the previous annual report, which showed the fund with around $932M in assets. The good news is that this decline seems to have halted. Let’s look at this year’s September numbers.

As you can see, the total value has increased by ~$11M. Importantly, this increase outpaces the increases in projected benefits owed (~$4M), which is the lowest number in each graphic. I guess one good thing is that the much-discussed bond market losses don’t seem to have hurt the fund. With the changing interest rate environment, many institutional investors have seen the values on their bond portfolios fall, as investors would obviously prefer the higher rates on more recently issued debt. In fact, MoM numbers indicate that the fund is one of those buyers of newer bonds, as their “core” bond holdings increased $7M MoM.

Obviously, one would have hoped that they could have gotten numbers up closer to their previous $900M+ levels, but at least they’ve stopped the bleeding. Also, this is probably useful for budget watchers. If the fund’s asset valuation numbers are relatively stable, then it is likely that the upcoming request from the city’s general fund should also be about the same as last year.

The good news is that the city has been in an improving fiscal position. Internet “sales” taxes are bringing in millions of dollars in new revenue via the city’s Use Tax. This means that lost local sales tax revenue is being replaced. Moreover, I would be that this is actually pull that revenue into the city, instead of the county. Now that less folks are driving out to purchase at stores “big box” stores, that would mean sales taxes on purchases that would have gone to the suburban taxing districts instead go to the city. In fact, the county’s lack of a Use Tax is probably having the opposite effect, by way of reduced revenue from lost purchases that used to happen at said suburban stores. The county’s ongoing, sales tax-related budget woes will probably just keep going, as more shopping shifts online. They really do need to convince the voters that the Use Tax is important for the county’s budgetary future.

That’s about all I’ve got. Like I said, this year’s number are basically the same as last year’s, so this wasn’t gonna be a super exciting post. More of an FYI. Luckily for everybody, Paul Payne’s (and most economists, tbh) oft-warned-about recession hasn’t materialized, though it could show up at any moment. As long as that continues, we’re looking at stasis in the fund’s semi-solvency and the city’s budgetary contribution. As always, if we do get a big decline in stock market values, then the city’s contribution will spike. That’s what happened in 2008. Unlike then, the fund would be coming into the drop in values with a balance sheet that was already in fairly poor shape. That means that the city would likely have to dig deeper, relative to the lost valuation in that potential downturn, when compared to the 2008 pension contribution that was paid by the general fund.

I hope everybody had a great Thanksgiving.

ps- Tips on potentially interesting, local public finance documents to be reviewed can be sent to burleigh@hotmail.com